OT Kid is good for online fashion store about kid fashion, kid clothing with colorful look & feel, fresh and clean. OT KID have been plugged with powerful Virtuemart 3.0 and so will also suitable for any web store.

Let's try it and enjoy!

FEATURES:

- 100% tableless CSS,with changeable width of template and column layouts.

- Solid pre-defined style.

- Hot Effects Rotator module pre-installed.

- Hot QuickStart (SQL dump) available with both single purchase or membership plan.

- 18 fully collapsible module positions.

- Validates with XHTML 1.0 Transitional.

- SEO friendly.

- Tested in IE7+, Firefox, Chrome, Safari and Opera browsers.

- Joomla! 3.6 Native

- Base Solid Framework

- Clean and well comments in CSS and PHP code

{jl-price}

Outstanding Features

Totally responsive

This is an Ultra-Responsive Joomla template and it’s optimized for modern handheld devices. Your content will always present perfectly on devices that boast high pixel density screens such as tablets and smart phones.

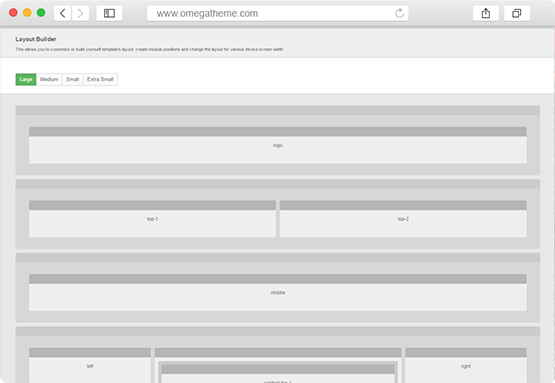

Drag-n-drop layout customization

You can quickly style the layout to suit your needs with drag-n-drop functionality. Without touching any code line, you are allowed to construct unlimited layout combinations.

Support Joomla 3 & Bootstrap 3

Joomla Business is developed based on Joomla 3 and powered with Bootstrap 3 framework. You can enjoy all the best things from them with no trouble at all. This combination helps your website achieve a stable and a standard website.

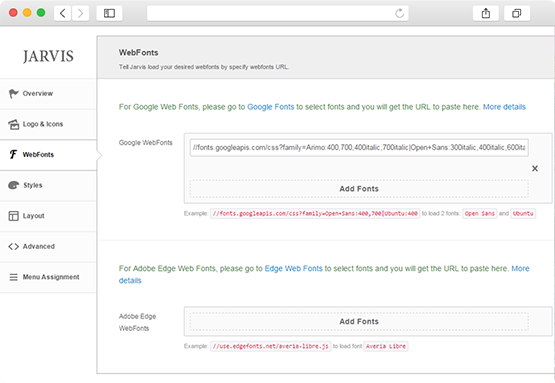

Support Google fonts & Edge web fonts

This Joomla business template supports more than six hundreds of Google Fonts and Edge web fonts that you can use for creating a visually interesting website.

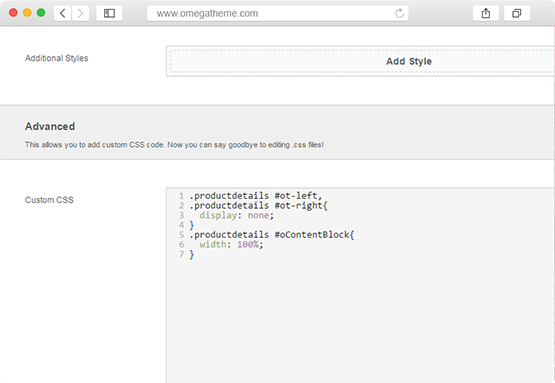

Editing .css files with ease

You want to add your own CSS code? Yes, you can do whatever you want without opening CSS file. Just simply add your custom CSS code right in the template manager.

You can check, edit and update the code without worrying about the template updates.

Custom Javascript in a minute

Adding the Javascripts code has never been easier. No more worry about missing the code somewhere, Joomla Business saves you a lot of time and effort on adding the javascript code in the right place.

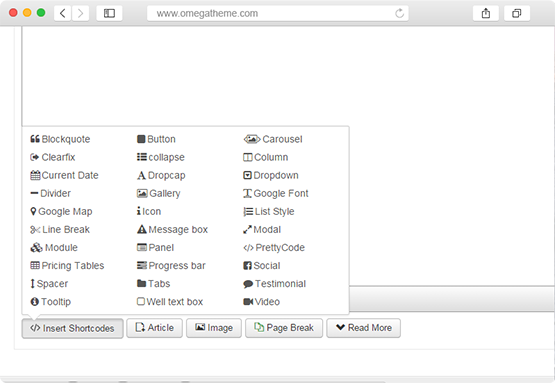

Built-in Shortcodes

This Joomla one-page template is built with 30+ fully functional shortcodes. These shortcodes not only empower your site, but also save your times a lot on template configuration. No need to have coding knowledge, you still can get your own site.

Support with care

Each product is out with extensive documentation and professional customer support. We care your trouble and we always try hard to support you as quickly as wec an. Feel free to contact us by creating a new topic at forum support, we will back to you soon

Do not be hesitate to join with us right now!